+1 281.734.9823......................[email protected]...........

You have sales.

You have profits.

Where's Your Cash?

Let me show you where your cash is hiding.

• Stop guessing where the cash went.

• See what public data reveals before you share anything.

• Know where to focus first.

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

You have sales.

You have profits.

Where's Your Cash?

Let me show you

where your cash is hiding.

Stop guessing where the cash went.

See what outside evidence reveals.

Know where to focus first.

Where Cash is Hiding

Your P&L looks fine but your bank account tells a different story. In many companies, cash gets tied up in day-to-day operations, and the patterns are hard to see from the inside.

Common places cash gets trapped:

• Schedule gets published but execution drifts.

• Shortages, substitutions and workarounds become normal.

• Rework uses capacity but it does not show up in reports.

• Everyone is busy but production does not increase.

• Disputes and collections issues cause a spike in receivables.

• Maintenance and CAPEX surprises lead to unplanned spending.

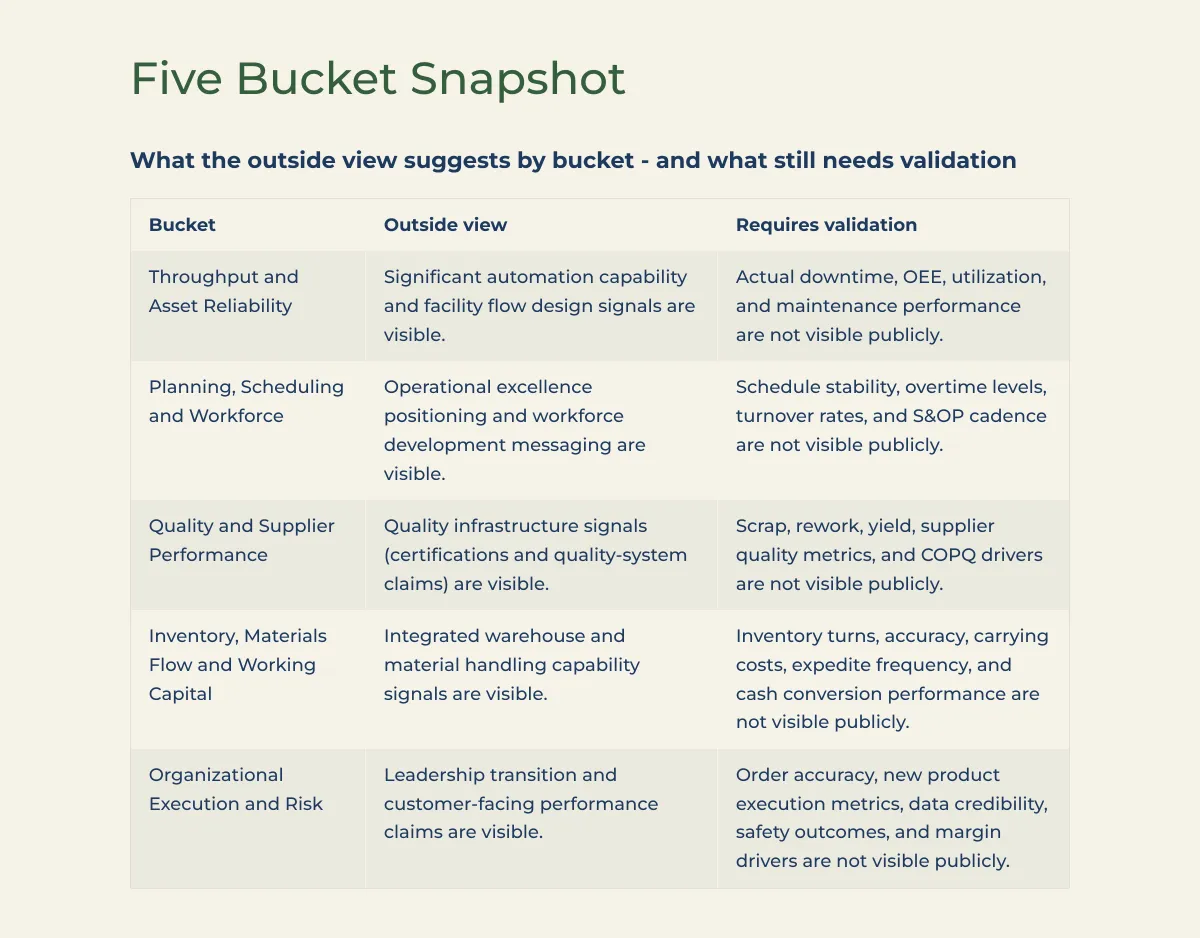

The Outside view doesn't assume the answer. It helps you see what's visible, what's not, and where uncertainty remains.

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

What You Get

In 20 minutes, you get a clear, outside-in explanation of what your public footprint suggests, what looks inconsistent, and what can't be known yet. You leave with clarity and a practical next step, not a list of guesses.

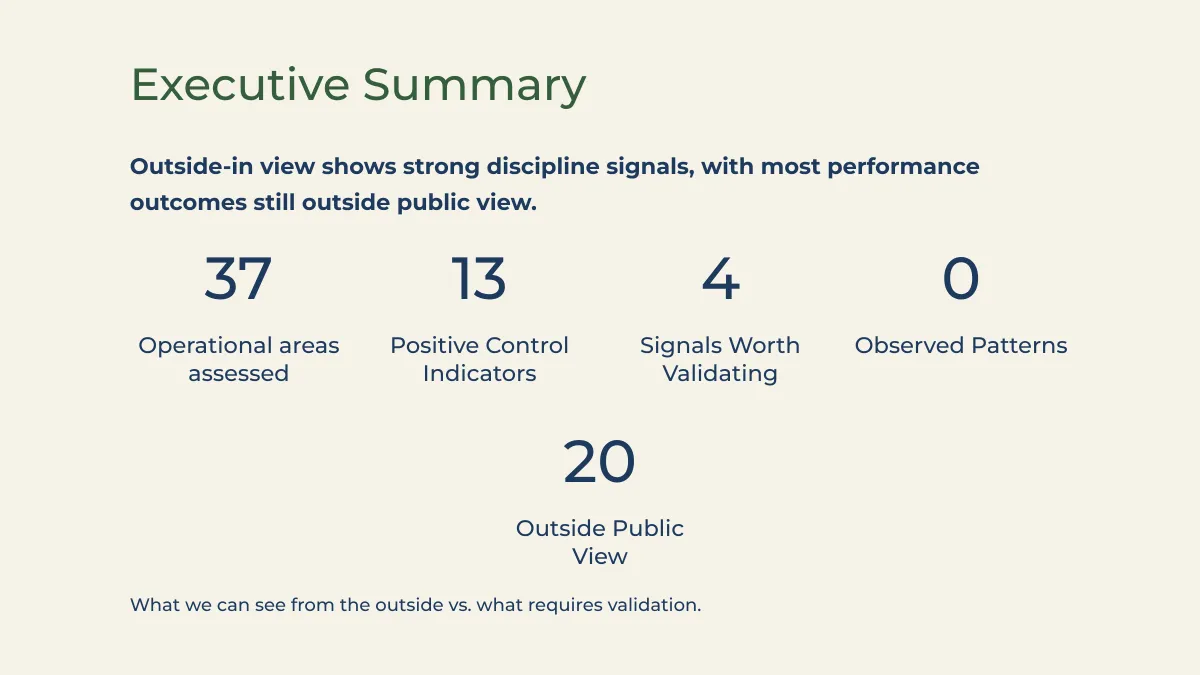

• A 10-page Outside View summary prepared in advance

• What looks strong from the outside

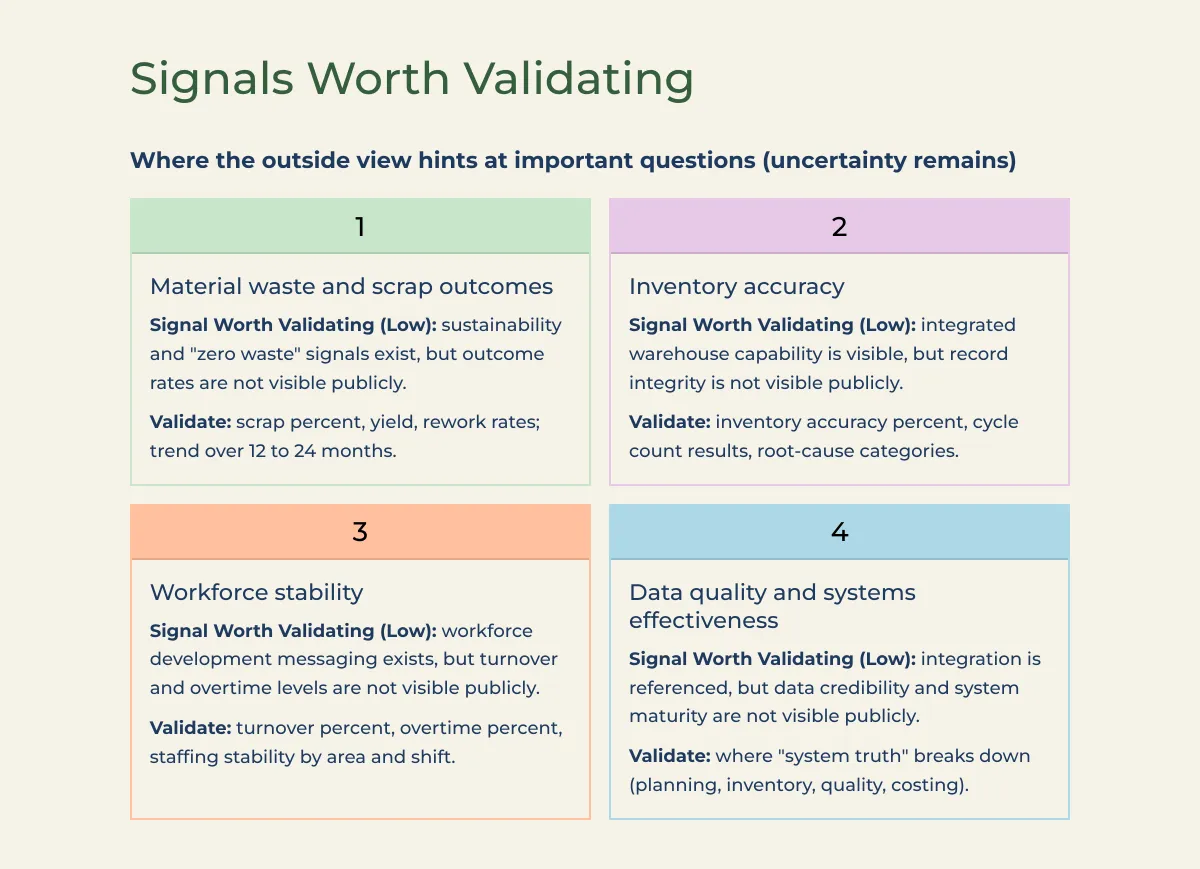

• What looks uncertain and needs validation

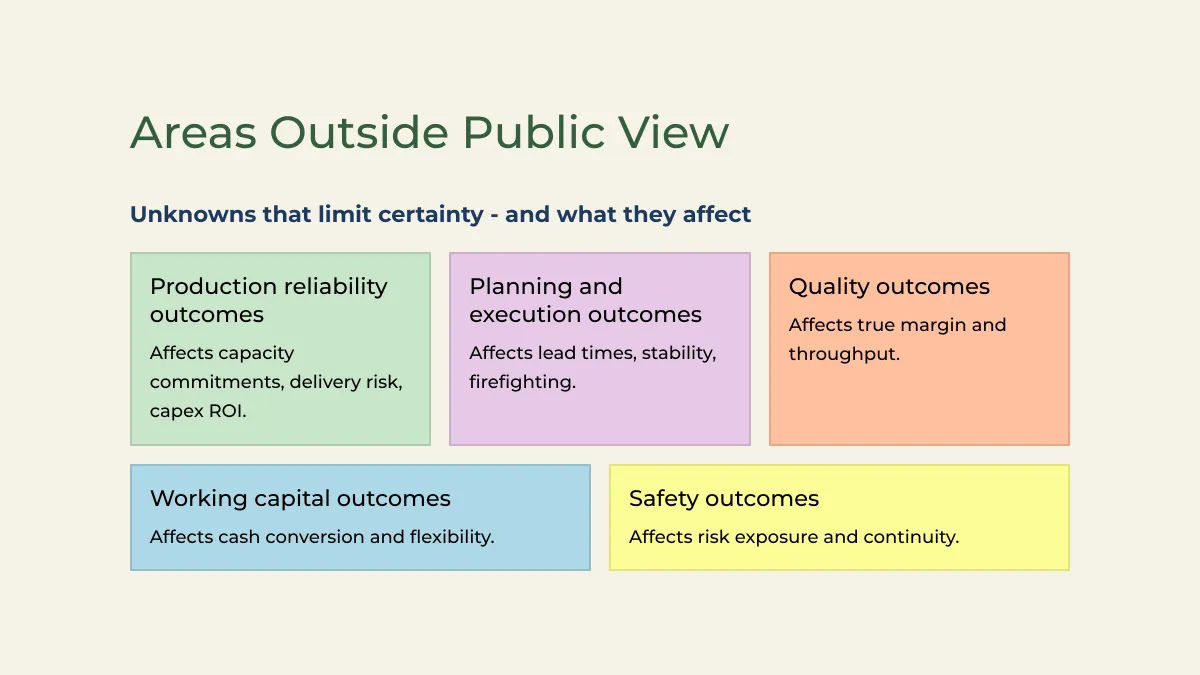

• What's hidden from public view

• Where to focus first

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

From an Actual Assessment

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

How It Works

No financials needed to start.

Step 1 - You schedule at least 3 business days out and provide only your company name and website.

Step 2 - I build The Outside View for your company after reviewing what is visible externally.

Step 3 - We review the results together in a 20-minute call. You leave with clarity on what's visible, what isn't, and what's still uncertain.

After the call we can discuss a next step. Your choice.

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

Who It's For

Mid-market manufacturing executives who want to know why there are profits on paper but no cash in the bank.

Good fit when:

• You have sales and profits, but cash is unpredictable.

• You're tired of surprises and the results don't match the effort.

• Your team is busy, but output and delivery don't improve.

• You want an independent perspective before you launch another initiative.

• You value evidence and clarity more than opinions.

Not a fit when:

• You want a quick fix without changing how work gets done.

• You want someone to confirm your current theory.

• You're looking for a generic consulting report.

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

Frequently Asked Questions

What do you need from me to get started?

Just your company name and website. No financial data, system access, or logins.

What happens on the 20-minute call?

I walk you through what I prepared and answer your questions. The goal is clarity: what looks strong, what looks inconsistent, and what's not visible from the outside.

Do you send the Outside View to me before the call?

No. I prepare it in advance, then we review it together live. You'll see it on the call, and you'll receive a copy after we meet.

Why is the earliest availability 3 business days out?

Prep time. I need a few business days to review what's available publicly and build your Outside View before we meet.

Is this a sales pitch disguised as a free assessment?

No. The Outside View is useful on its own. If it reveals something worth confirming with internal data, we can discuss the next steps. If not, you still leave the call with a clearer perspective on your business. Your choice.

What can you actually see from the outside?

Public signals and patterns. Things like how your business presents itself to external stakeholders, what you emphasize, what appears inconsistent, and what's missing. Some issues can't be confirmed without internal data, and I'll be clear about that.

What industries is the Outside View designed for?

Mid-market manufacturing because manufacturing operating patterns and cash flow dynamics are complex. Cash often gets tied up in inventory, work-in-process, capacity loss, and lead-time variability in ways that don't show up clearly on standard reports.

Start with your company name and website. No financial data needed. Complimentary.

20-minute call. Earliest availability: 3 business days out (prep time).

Who's Behind This?